West Coast Situation in 2023

Shipping volume shifts to East Coast ports

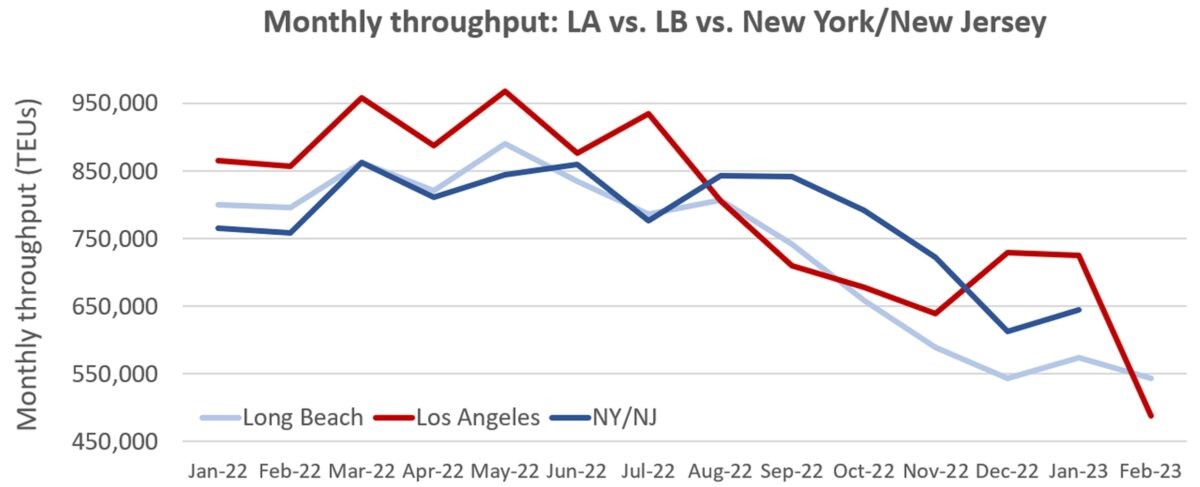

As a consequence of the unsettled labor situation at West Coast ports as of early 2023, shippers have shifted much of their cargo to ports on the east coast

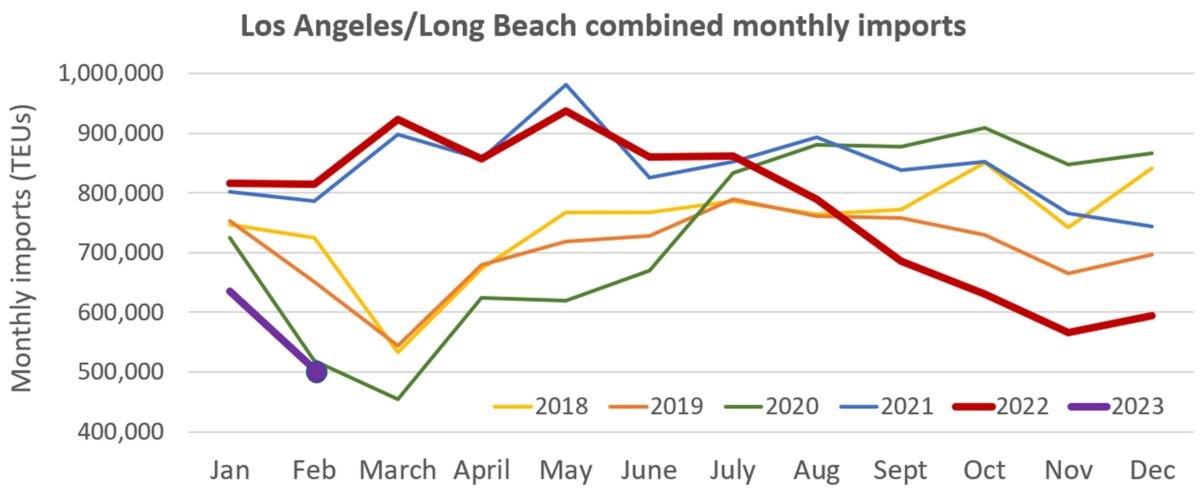

As of December, cargo volume declined by 25% at the Port of Los Angeles, knocking it off the top spot in the U.S. that it’s held for 22 years as the Port of New York and New Jersey has taken over. Other alternative ports like Houston, New Orleans and Savannah have seen jumps as well. The shift is not purely due to labor concerns, as the movement began when the Ports of L.A. and Long Beach dealt with such congestion that dozens of cargo ships – in fact, more than 100 at this time last year – were waiting offshore for a chance to deliver goods

(Chart: FreightWaves based on data from ports of Los Angeles and Long Beach)

What’s next on 2023

The counterargument is that much of the volume that shifted to the East and Gulf coasts is gone for good. Fears of congestion and labor unrest may have precipitated the original decision to switch coasts, but now that new supply chains are in place, importers will stick with them even after a West Coast labor deal is reached.

While there are a number of reasons cargo volume shifted east in the U.S., it’s no sure thing that it’ll shift back even when those issues resolve. For instance, the port congestion that plagued Los Angeles and Long Beach is gone, but a recent survey indicates many logistics managers – nearly a third – who’ve made the move away from the west coast may not return, even if a labor deal is reached

On top of that, more shipping services to the East Coast have ever had before, and the [ocean freight] spread between the East Coast and the West Coast is now very little. For one carrier, it’s down to $850 [per 40HC]. That’s nothing compared to what it costs to truck goods across the country

Many importers used to only have one DC [distribution center] or warehouse on the West Coast, where they would do their international transport from Asia to Southern California. From there, they would do domestic across the country. Because of everything that happened in the last two years, they were forced to open and sign a contract with another DC on the East Coast.

The optimistic theory on Southern California ports is that shippers will bring back volumes once a labor contract is finalized and a labor disruption is off the table.

(Chart: FreightWaves based on data from ports of Los Angeles and Long Beach)