US seaborne imports fell 20% year over year in February

Written date: 15 Mar 2023

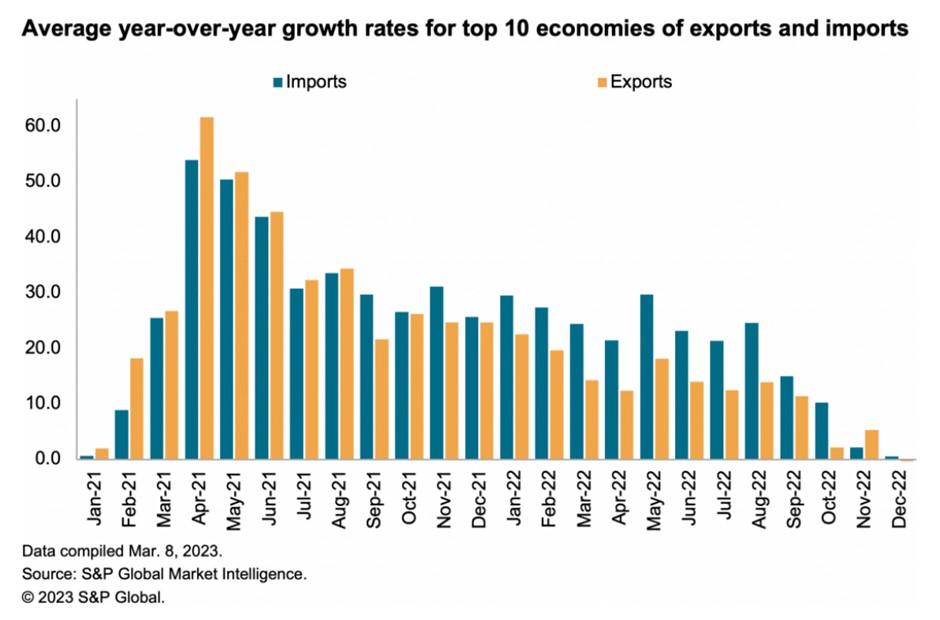

In new research this week, S&P Global Market Intelligence has taken a deep dive into US bill-of-lading data to provide an up-to-date view of supply chain activity.

– Ocean bill-of-lading data has manifested that there’s a lower latency, higher granularity guide to supply chain activity than regular macroeconomic data, at the cost of being less complete.

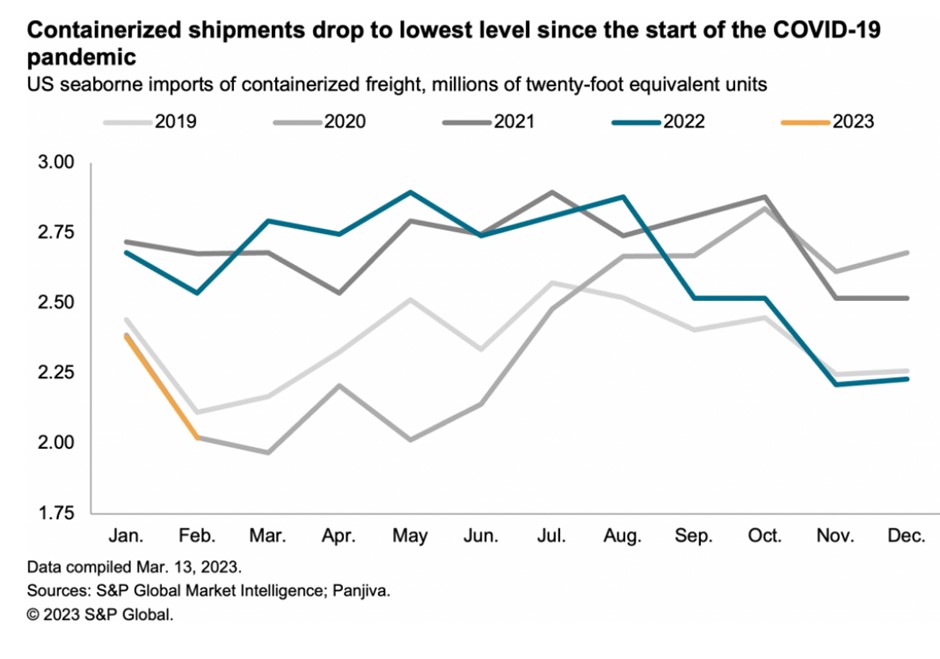

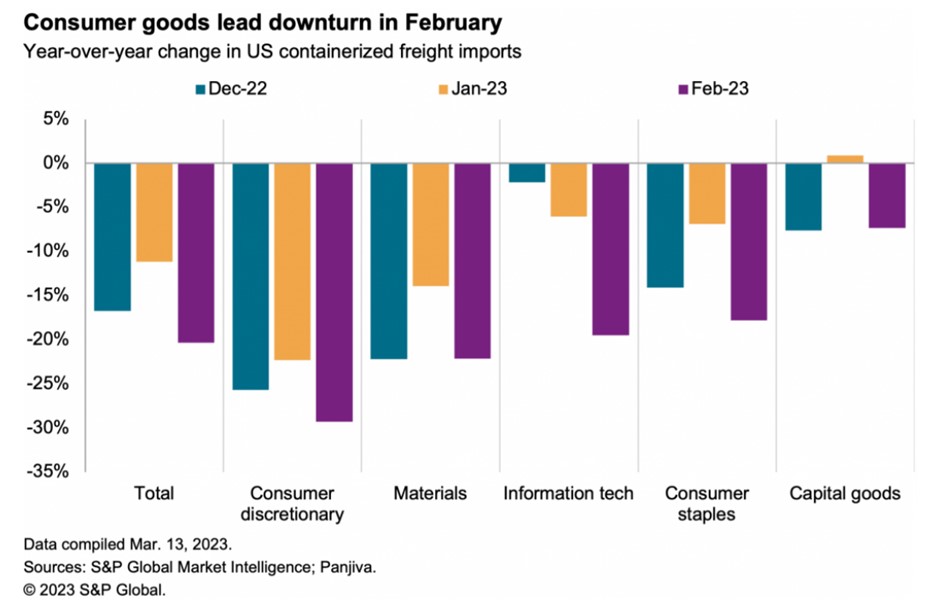

The United States seaborne containerized cargo imports fell 20% in February compared to this month last year, giving the signal of an ongoing slowdown in supply chain activity across an extended range of industries.

Non-essential consumer products are on top of the downturn – decreasing by 29%, meanwhile, consumer essential shipments fell 12%.

– Among the consumer goods sector, the fastest decline belongs to home furniture importing activity, with shipments down 36% and leisure goods (including fitness equipment) – decreased 39%.

– Digging deeper into home furnishings, we noticed that shipments of some retailers were down 50% or more compared to the same period last year. The full report identifies key furniture shipping companies, with S&P Global Market Intelligence Panjiva data.

Consumer goods: Sales furled

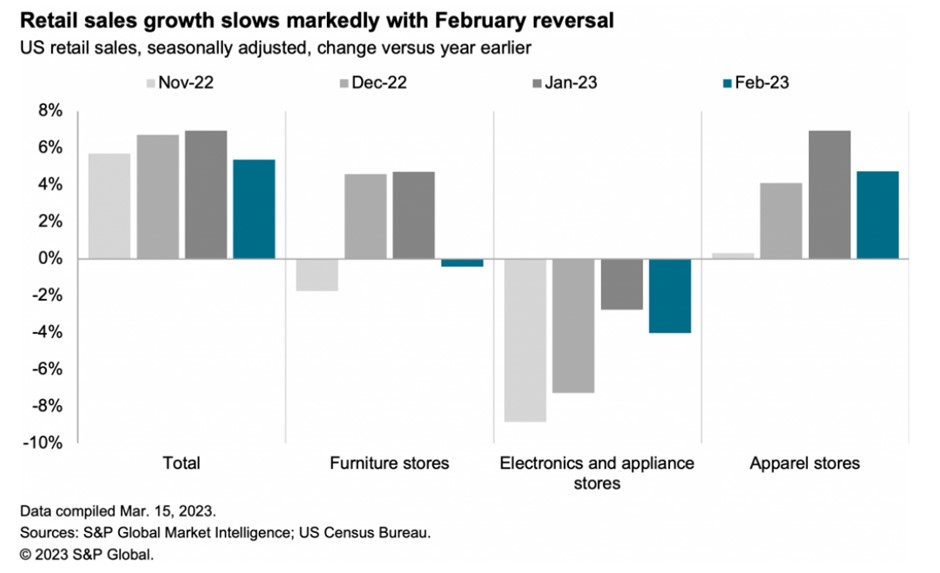

US retail sales fell 0.4% consecutively in February 2023 on a seasonally adjusted basis after recovering 3.5% in January. Despite the fact that sales number increased 5.4% year-on-year, but that was the slowest growth rate since December 2020.

– Having a quick opposite from the garment sector, where sales numbers increased 4.7%, meanwhile, the increasing number was 6.9% in January. Electronics and appliance stores were the two sectors having the quickest down trend, particularly fell by 4% compared to furniture stores fell by 0.4% year over year.

– The whole US importation of clothing products (including clothing, garment and accessories) cut down 4% in January, based on S&P Global Market Intelligence GTAS data. In the second month of 2023, initial data from S&P Global Market Intelligence Panjiva Shows that US ocean imports plummeted 33%.

– The future situation is still cloudy. A variety of clothing retailers, such as Gap Inc, predicted that net sales in the following year “could decrease in the low to mid-single digit range”. The company expected “planning for inventory will be down more than sales” as well, over the same quarters, implying a favorable opposite in its supply chain management.

– Shoemaker – Allbirds – takes part in the down trend, which is a 20-28% slide in revenue in the finance first quarter of 2023 compared to the previous year. The manufacturer has also planned to take advantage of the markdown to make sure that it’ll adjust the line and takes steps into the new year 2024 with a cleaner inventory position.

– There was a forecast by Donna and Nautica – owner of G-III Apparel – suggested that their revenue will be jumped down by 19% year over year in the first month of 2024, citing “inflationary pressure on consumers”. The two founders have also expected to be lost owing to “incremental costs associated with managing higher levels of inventory”.

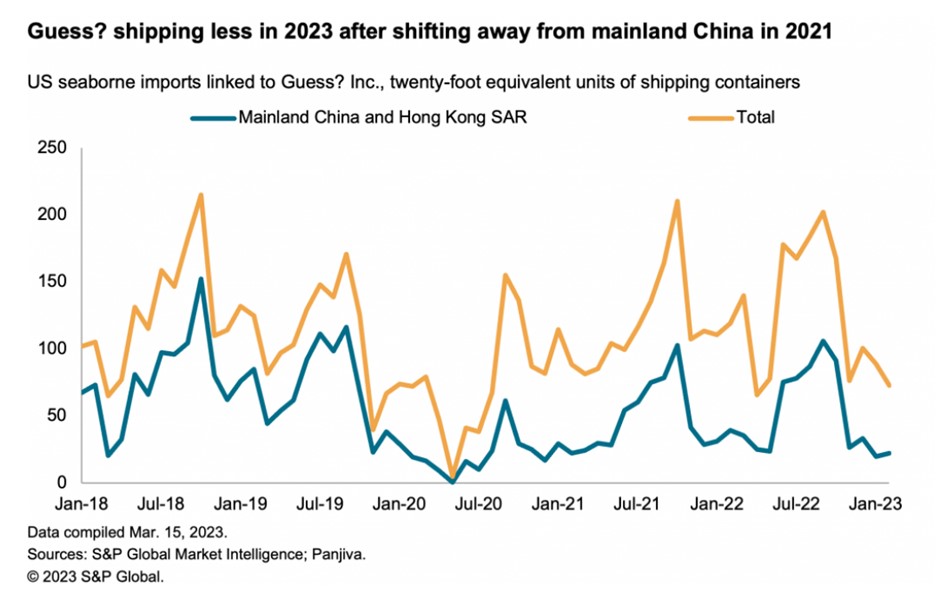

Clothing retailer – Guess has reported that there was 2% growth in total revenue in the quarter of three months to Jan 28 2023, which is 1% decline in Americas retail revenue and 27% decline in wholesale revenue.

-The company forecasted revenue will “decrease between 7% and 6% in the upcoming quarter”, they also suggest “consumers to remain prudent in their spending” and “retailers will prioritize maintaining tighter inventories than last year”.

– Guess-related US seaborne imports fell 39% in February 2023 year-on-year, following declines of 20% in January and the fourth quarter of 2022, according to S&P Global Market Intelligence Panjiva. That would mean reducing purchases to further reduce inventories.

– Guess is streamlining its supply chain to “reduce costs and increase sourcing distances to improve market distribution.”

– In the 12 months ended by 28 February 2023, the share of company-related imports from Mainland China and Hong Kong SAR fell to 41% and from 61% in 2018. Imports now come from India at 13% and Bangladesh at 19%.